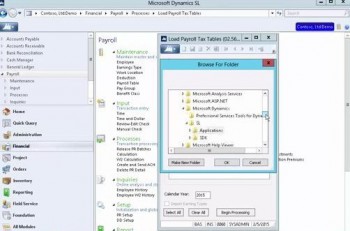

Once you’ve downloaded the updates, extract all files from the download. Log on to Microsoft Dynamics SL, and under the Processes heading, select Load Payroll Tax Tables. In the Load Payroll Tax Tables screen, click Browse to browse to the location of the tax table files you have extracted. Click OK, and all the files will be listed in the Load Payroll Tax Tables screen.

You can click the Select All button to select all of the files. This would import all of the state files and the federal file. You can also select only the files you want one at a time. Click the Clear All button to unselect all files. Double-check the calendar year field to ensure that it is correct. When you are satisfied with your selections, click the Begin Processing button. When this process is complete, click OK and the tables are now imported.

You can verify the downloads in the Deduction Maintenance screen. Also included with the tax table updates is a PDF entitled Deductions Types. It shows you what the standard demo database tax tables would look like with the imported tax table updates. You can compare it to how yours looks to ensure that all is well.